accounting Services

Our expertise to serve you

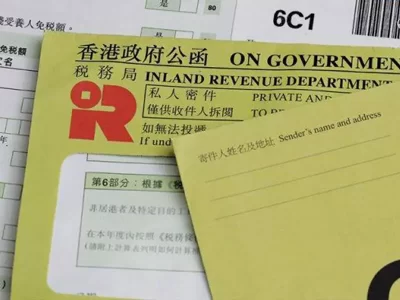

IRD's requirements.....

Section 51C of the Inland Revenue Ordinance requires every person carrying on a trade, profession or business in Hong Kong to keep sufficient records in the English or Chinese language of his income and expenditure to enable the assessable profits to be readily ascertained. Such records shall be retained for a period of not less than 7 years.

Well prepare for you.....

If you are a newly start-up or already run for a certain period of time, and you are lacking of experienced bookkeeper, we can do it for you.

Provide us the following documents: (1) Bank Statements; (2) Sales / Purchase Invoices; (3) Expenses invoices / bills; (4) Bank Receipts / Transfer doc, etc., we can prepare the work for you.

Sufficient records are ready for you.....

Every month, reports such as (1) Trial Balance; (2) Profit and Loss Accounts; (3) Balance Sheets; (4) General Ledgers; (5) Sub-ledgers; and (6) Accounts Receivable / Payable Registers, etc., are ready for your review.

Bear in mind that, company should properly prepare and maintain the books and records at any time.

Generally, Profits Tax Return would be issued in April and it should be filed within 1 month. Tax payer should pay tax before the specified date.

How to handle the Tax Return?.....

In general, the following documents should be submitted together: 1) completed Tax Return; 2) auditors' report; 3) tax computation statement.

Inland Revenue Department will make the assessment based on the submitted information, then a notice of demand for payment of tax would be issued.

So, well prepare of the accounting records at any time is crucial. It is not only the owner can understand the financial performance of the company, but also to prevent any surcharge due to the late submission of information.

Our fee.....

We charge at a reasonable price for our professional services. We won't ask an unbelievable low price but offering you a cheap service. Our goal is to provide an excel professional accounting service to you!!